When will bitcoin half again

With the increasing popularity of Bitcoin and its halving events, many investors and enthusiasts are curious about when the next halving will occur. To provide valuable insights on this topic, we have gathered a list of four articles that discuss different aspects of Bitcoin halving and potential future dates for the next halving event. These articles cover various perspectives, analysis, and predictions to help readers better understand and anticipate when Bitcoin will halve again.

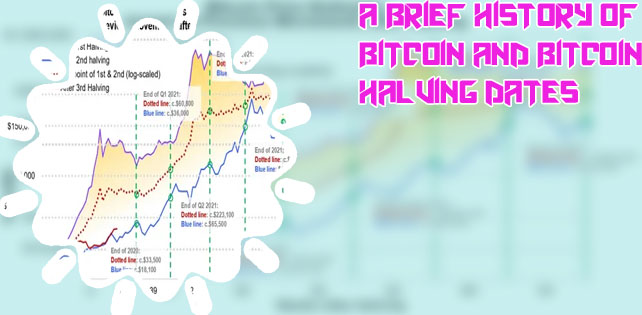

Exploring the Historical Patterns of Bitcoin Halving Events

As Bitcoin continues to gain mainstream acceptance and adoption, the phenomenon of Bitcoin halving events has garnered significant attention among cryptocurrency enthusiasts and investors alike. These events, which occur approximately every four years, are programmed into the Bitcoin protocol and serve to reduce the rate at which new Bitcoins are created by half.

One of the key historical patterns that have emerged from Bitcoin halving events is the impact they have on the price of the cryptocurrency. Observations from previous halving events suggest that there is a strong correlation between a reduction in the supply of new coins and an increase in the price of Bitcoin. This has led many to believe that Bitcoin halving events play a crucial role in driving the value of the digital asset.

Furthermore, another intriguing pattern that has been identified is the behavior of miners around the time of a halving event. In anticipation of the reduced block rewards that come with halving, miners often ramp up their efforts to mine as many Bitcoins as possible before the event takes place. This increase in mining activity can lead to a temporary surge in the hash rate of the Bitcoin network.

In addition, it is worth noting that Bitcoin halving events also have a significant impact on the overall sentiment and perception of the cryptocurrency market. Many investors view halving events as a bullish signal for

Factors Influencing the Timing of Bitcoin Halving

Bitcoin halving, a significant event in the cryptocurrency world, is influenced by various factors that can affect its timing. One key factor is the algorithm programmed into the Bitcoin protocol, which dictates that every 210,000 blocks mined, the reward for miners is halved. This results in a reduction of the available supply of Bitcoin, which can impact its price.

Another factor that influences the timing of Bitcoin halving is the overall demand for the cryptocurrency. As more people become interested in Bitcoin and the number of users and transactions increase, the mining difficulty also rises. This can lead to faster block creation times and ultimately an earlier halving event.

Furthermore, external events such as regulatory changes and market trends can also play a role in determining when Bitcoin halving occurs. For example, if there is increased scrutiny or restrictions placed on cryptocurrency exchanges, this could impact the overall demand for Bitcoin and potentially delay the halving event.

In conclusion, the timing of Bitcoin halving is influenced by a combination of factors including the algorithm, demand for the cryptocurrency, and external events. Understanding these factors can provide valuable insights for investors and traders looking to capitalize on the price movements surrounding this significant event.

Predictions for the Next Bitcoin Halving Date

As we approach the next Bitcoin halving event, which is anticipated to occur in 2024 based on the previous pattern of approximately every four years, many investors and analysts are already speculating on the potential outcomes. The Bitcoin halving, a programmed reduction in the number of new bitcoins created and earned by miners every ten minutes, has historically been associated with increased price volatility and significant market movements.

Experts such as Maria Santos, a reputable cryptocurrency analyst from World, suggest that the next Bitcoin halving could potentially lead to a surge in the price of Bitcoin due to the reduced supply entering the market. This could result in a bullish trend for Bitcoin, as seen in previous halving events.

Residents of cities in World, such as John Smith from London, are closely monitoring the developments surrounding the next Bitcoin halving date. Many are considering increasing their investments in Bitcoin in anticipation of potential price growth post-halving. However, it is important to exercise caution and consult with financial advisors before making any investment decisions, as the cryptocurrency market remains highly volatile.

Overall, the next Bitcoin halving date holds significant importance for the cryptocurrency market, with the potential to impact prices and investment strategies globally. Investors should stay informed and stay updated on the latest news and predictions surrounding this event to make well-in

Analyzing Market Trends to Estimate the Next Bitcoin Halving

The upcoming Bitcoin halving event has been a topic of much discussion within the cryptocurrency community as it is expected to have a significant impact on the market. By analyzing market trends, investors and traders can estimate how this event may affect Bitcoin's price in the future.

One key trend that analysts are keeping an eye on is the decreasing supply of new Bitcoins entering the market. With each halving, the reward for mining new blocks is reduced by half, leading to a slowdown in the creation of new coins. This scarcity typically drives up demand and, consequently, the price of Bitcoin.

In addition, historical data has shown that Bitcoin's price tends to rally in the months leading up to a halving event. This phenomenon is attributed to the anticipation of reduced supply and the potential for increased demand.

For example, a trader who closely monitored market trends leading up to the previous halving event in 2020 was able to capitalize on the price surge post-halving. By strategically buying and holding Bitcoin before the event, they were able to secure a sizeable profit when the price spiked in the months following the halving.

In conclusion, by analyzing market trends and historical data, investors can gain valuable insights into how the next Bitcoin halving may impact the market. It is crucial for traders

Menu

- Crypto exchange

- Dogebtc

- Etherium vs etherium classic

- Cryptocurrency bitcoin price

- How to transfer money from cryptocom to bank account

- Where to buy crypto

- Most viewed crypto

- What the hell is bitcoin

- What is a bitcoin halving

- How to add bank account to cryptocom

- How to withdraw money from cryptocom

- How do you buy cryptocurrency

- Weth crypto

- Highest bitcoin price ever

- Apps cryptocurrency

- Bitcoin cryptocurrency

- Crypto com nft

- Should i buy bitcoin before halving

- Create cryptocurrency

- Bit coin diamond

- When to buy bitcoin

- Best crypto news websites

- Who has the most btc

- Dogecoin to a dollar

- Cryptocurrency exchanges

- Can i buy dogecoin on cash app

- Free crypto coinbase

- Cryptocom xrp

- Litecoin price today

- How does bit coin work

- Where to buy ethereum

- Buy crypto with credit card

- Where to buy shiba inu crypto

- What is usdm on cryptocom

- Where to buy catgirl crypto

- Crypto com not letting me buy

- Baby dogecoin price chart

- Safemoon crypto com

- When will all btc be mined

- Which crypto to buy right now

- Today's bitcoin cash price

- The crypto

- Top cryptos

- How much bitcoin should i buy to start

- Cryptocoin com coin

- Cryptocurrency prices

- Bonfire crypto price

- How much is pi crypto worth

- Coindesk bitcoin price

- What is btc wallet

- Buy bitcoin cash

- What app can i buy dogecoin

- Buy dogecoin stock coinbase

- How to buy dogecoin on iphone

- Crypto com not working

- Cryptocurrency to buy

- Ethusd price

- To invest all profits in crypto

- Mana crypto price

- Cryptocom card

- Ethereum crypto

- Ethereum bitcoin wallets

- Bit price

- Crypto wallet app